hawaii general excise tax id number

In August 2017 Hawaiis Department of Taxation began a modernization project which also. Outline of the Hawaii Tax System as of July 1 2021 4 pages 171 KB 11102021.

As of 2017 the license costs 20.

. Ge last 4 digits of your fein or ssn. Hawaii Tax ID Number Changes. See Hawaii Tax ID Number Changes for more information.

Tax Reporting of Scholarships and Fellowships. Use this search engine to find the latest Hawaii Tax ID numbers for Cigarette and Tobacco Fuel General Excise Sellers Collection Transient Accommodations Use and Withholding tax accounts. Find resources for Government Residents Business and Visitors on Hawaiigov.

Where can I look up my Hawaii Tax ID. 11 rows If you are stopping your business temporarily you can request to put your general excise tax transient accommodations tax rental motor vehicle tour vehicle and car-sharing vehicle surcharge tax and withholding tax licenses on hold using Form L-9An account may be put on Inactive status for up to two 2 years. General Excise Tax License Search.

It offers a number of online resources for consumers including licensee status and licensing complaints tax and business registration and other educational materials. We guarantee you will receive your EIN within 1-2 business days but many applications are processed. The Hawaii SalesTax ID card that is issued after the modernization project with a 13 letter heading is titled GE.

The Hawaii State Tax ID. The Legislature also authorized county governments. If you have a Hawaii Tax ID you can add tax licenses such as employers withholding transient accommodations cigarette.

The get is a privilege tax imposed on business activity in the state of hawaii. Rental Motor Vehicle Tour Vehicle and Car-Sharing Vehicle Surcharge Tax RV Taxpayers will benefit from faster. Travel and Moving Expenses.

You apply by filling out GE Tax Form BB-1. Hawaii General Excise Tax Id Number. Federal E mployer Identification Number FEIN from the IRS or.

Make sure you seek out the most updated form as Hawaii has revised the form recently and there are some links leading to Hawaii Government Web Pages that are out of date. In some cases you may have to wait for the Federal Tax Identification Number of your business entity if you are just organizing things. Form BB-1 can be filed online or mailed.

An extension for an additional two 2. The Department of Taxation is moving to a new integrated tax system as part of the Tax System Modernization program. A Form W-9 may be requested by the payor for UHs federal identification number.

98-8 October 30 1998. To learn more about the differences between the GET and sales tax please see Tax Facts 37-1 General Excise Tax GET. To learn more about the differences between the GET and sales tax please see Tax Facts 37-1 General Excise Tax GET.

34 rows General Excise and Use Tax Forms. As of August 14 2017 this system supports the following business tax accounts. Hawaii Tax ID Number A tax account with a two alpha character tax type prefix followed by a ten digit Hawaii tax.

Hawaii General Excise Tax is an additional tax totally in addition to federal and state income tax on the gross income of most Hawaii businesses and other activities. This ID number should not be associated with other types of tax accounts with the state of Hawaii such as income tax. Hawaii General Excise Tax.

Unrelated Business Income Tax. Hawaii GE Tax Question 2 How do I Get a GE Tax License. 2006-15 General Excise Tax GET and County Surcharge Tax CST Visibly Passed on to Customers 2018-14 Kauai County Surcharge on General Excise Tax and Rate of Tax Visibly Passed on the Customers 2018-15 Hawaii.

Check on whether a business or individual has a general excise tax license with the State of Hawaii Department of Taxation. The General Excise Tax License can be obtained by registering online through the Hawaii Business E xpress website or the Department of Commerce and Consumer Affairs Business Action Centers or by mailing in Form BB-1. For more information see Tax Facts No.

While Hawaii Tax ID numbers have changed for Corporate. This is your license or registration number for your General ExciseUse and County Surcharge Tax GE account. How to register for a General Excise Tax license in Hawaii.

37-1 General Excise Tax GET and Tax Announcement Nos. The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use Tax on Imports For Resale and 4 for all others. Tax Office at UH can prepare such form and sign it and provide the address of your office and an email address where such signed.

Sales Tax Tuesday 2018 Hawaii Special Edition Insightfulaccountant Com

Licensing Information Department Of Taxation

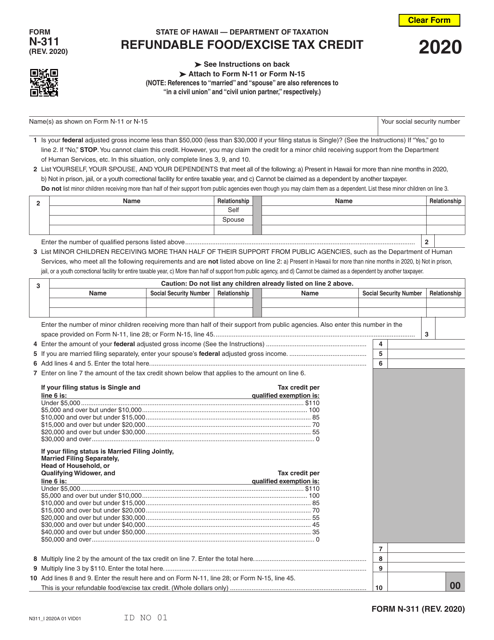

Form N 311 Download Fillable Pdf Or Fill Online Refundable Food Excise Tax Credit 2020 Hawaii Templateroller

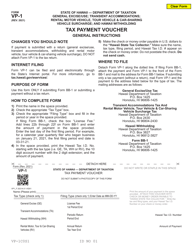

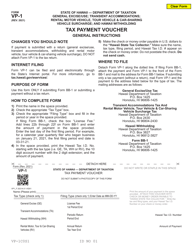

Form Vp 1 Download Fillable Pdf Or Fill Online Tax Payment Voucher Hawaii Templateroller

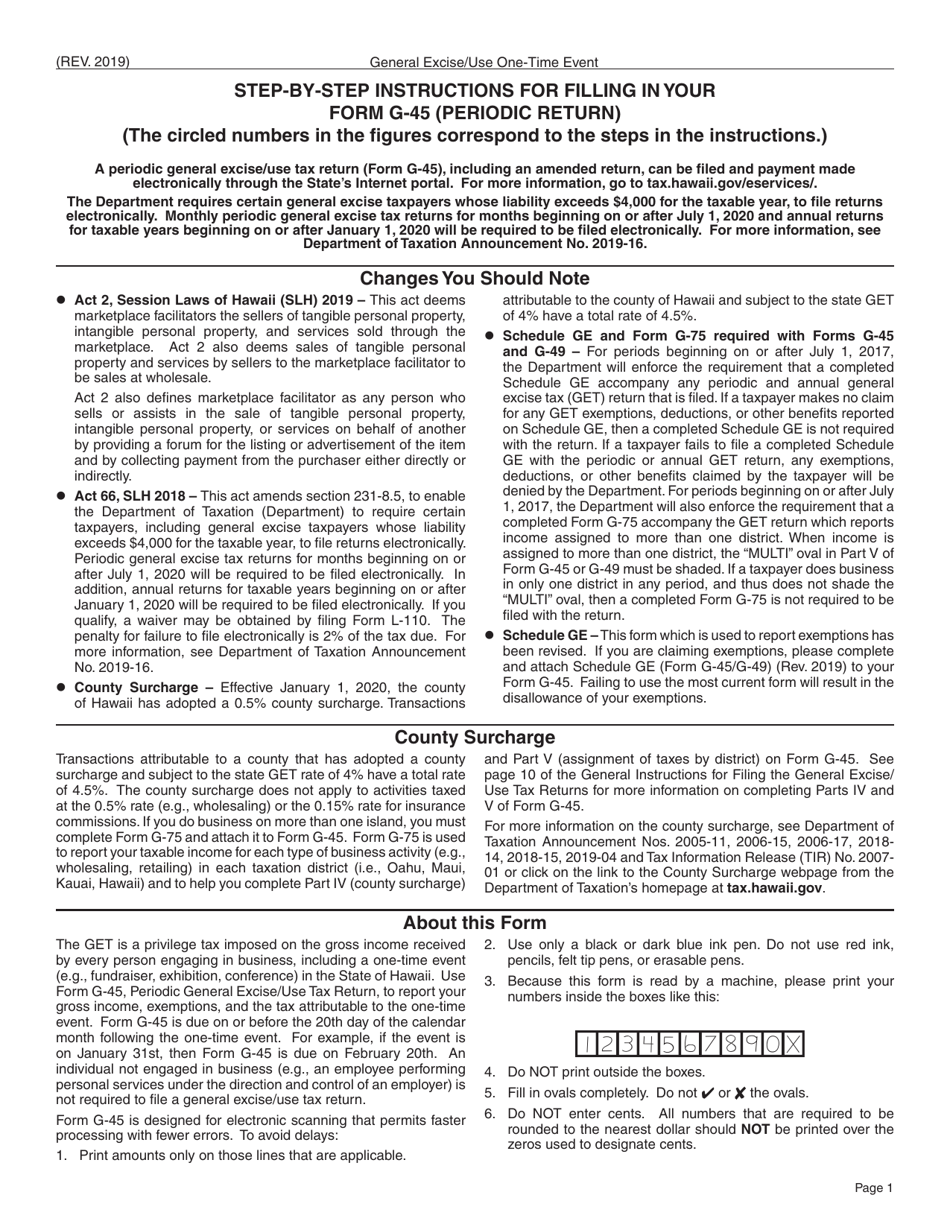

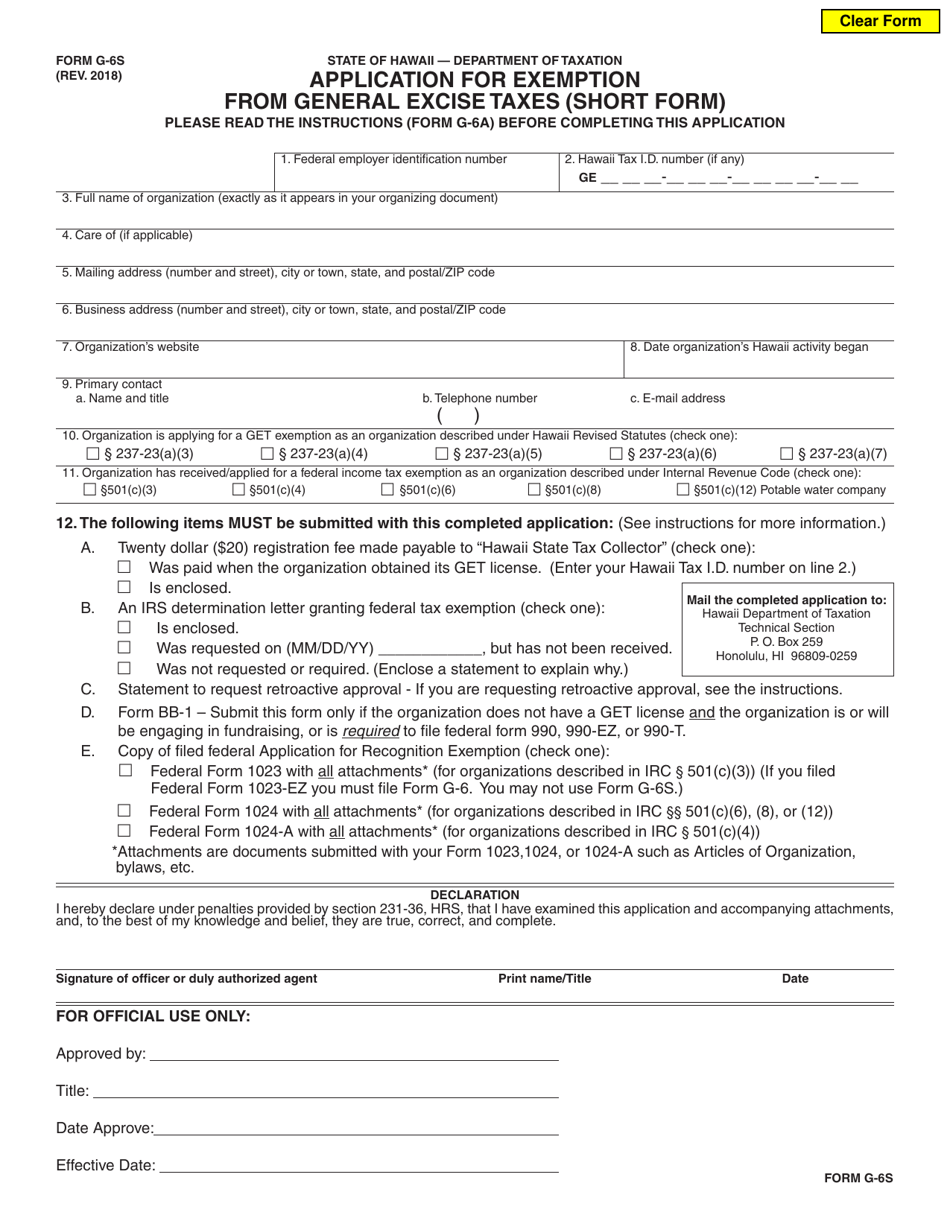

Download Instructions For Form G 45 General Excise Use Tax Return Pdf Templateroller

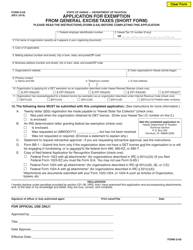

Form G 6s Download Fillable Pdf Or Fill Online Application For Exemption From General Excise Taxes Short Form Hawaii Templateroller

Form G 6s Download Fillable Pdf Or Fill Online Application For Exemption From General Excise Taxes Short Form Hawaii Templateroller

Hawaii Ge Tax The 10 Most Frequently Asked Questions

How To Find Hawaii Business License Ictsd Org

Download Instructions For Form G 45 General Excise Use Tax Return Pdf Templateroller

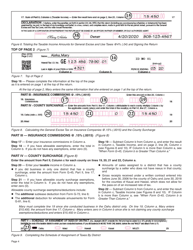

Download Instructions For Form G 45 G 49 Pdf Templateroller

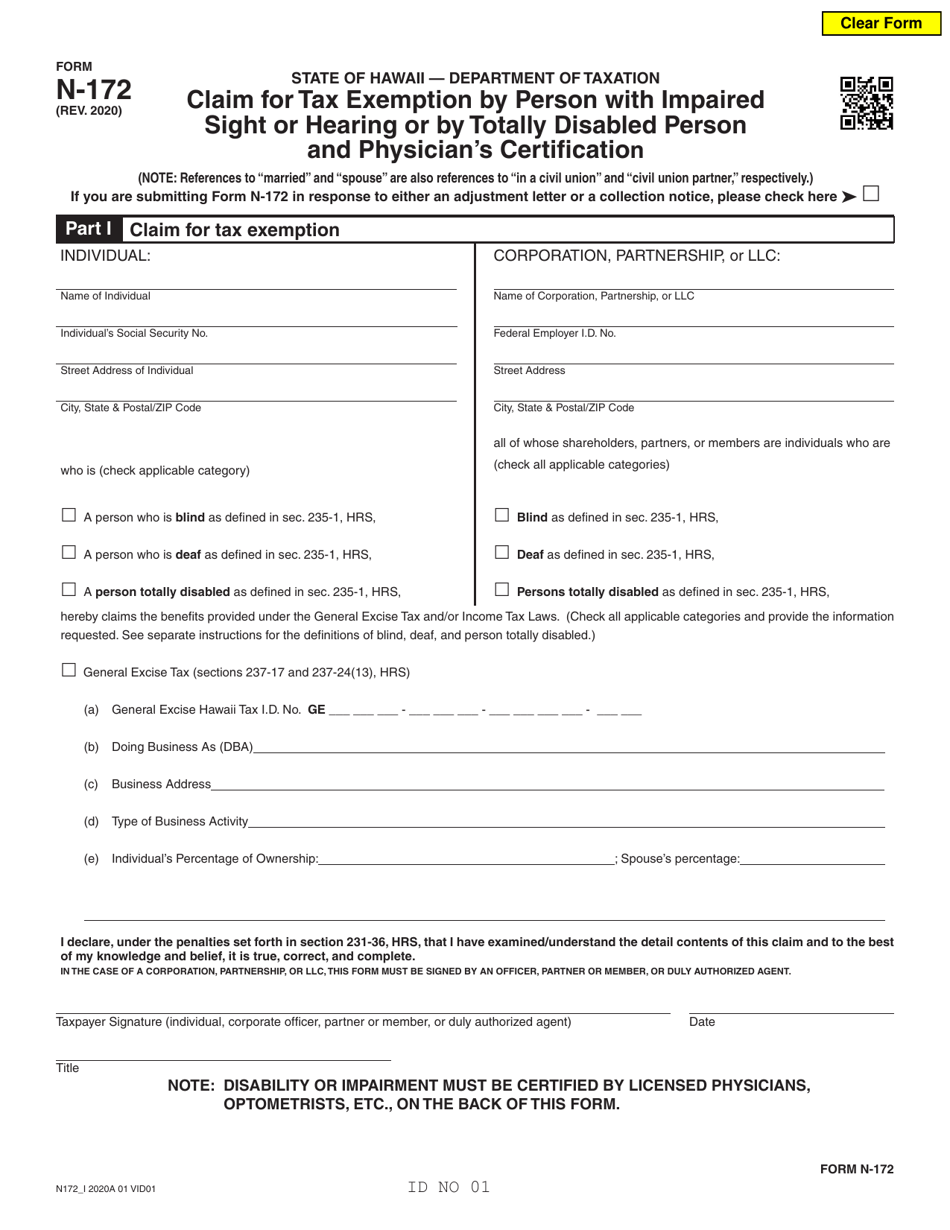

Form N 172 Download Fillable Pdf Or Fill Online Claim For Tax Exemption By Person With Impaired Sight Or Hearing Or By Totally Disabled Person And Physician S Certification Hawaii Templateroller

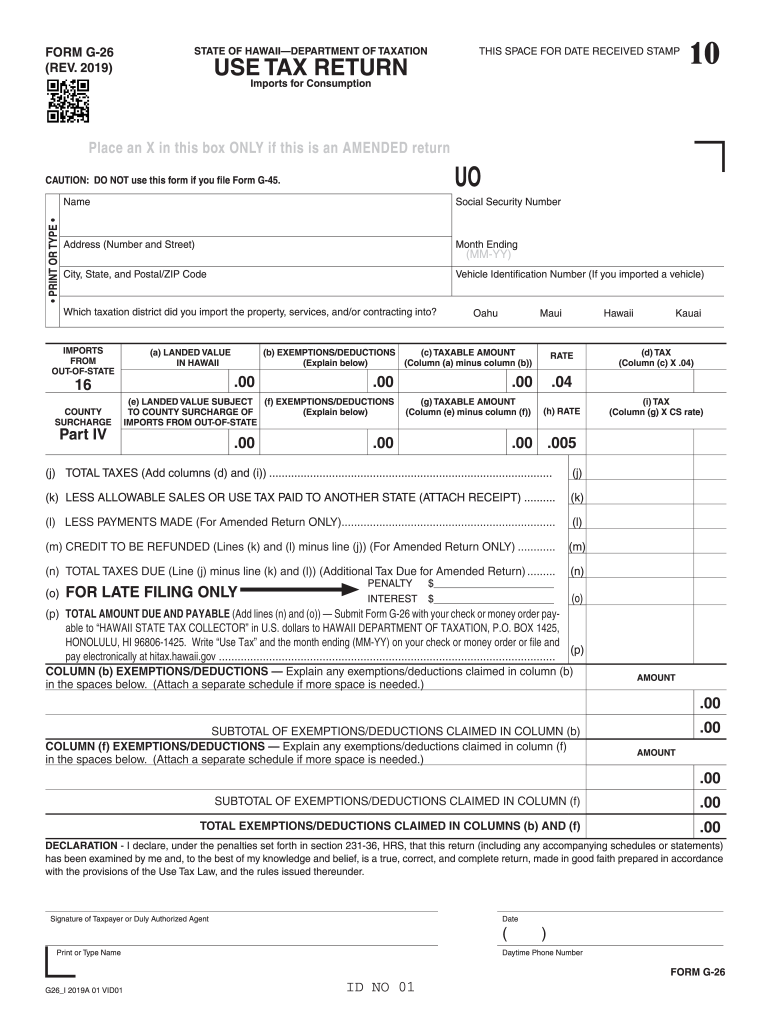

Hi G 26 2019 2022 Fill Out Tax Template Online Us Legal Forms

How To Find Hawaii Business License Ictsd Org

Form Gew Ta Rv 5 General Excise Use Employer S Withholding Transient Accommodations Rental Motor Vehicle And Tour Vehicle Surcharge Application Changes Rev 2009